Xero, Quickbooks and Sage 50 for Payroll, TAX, VAT, Accounting & Bookkeeping

Flash Sale 61% OFF | 11-in-1 Bundle | CPD Certified | 110 CPD Points | Gifts: Hardcopy + PDF Certificate + SID-Worth 180

Apex Learning

Summary

- Certificate of completion - Free

- Certificate of completion - Free

- Exam(s) / assessment(s) is included in price

- Tutor is available to students

Add to basket or enquire

Overview

*** Limited Time Offer: 11 Courses Package + 11 Free PDF Certificates ***

Get expertise in Xero, Quickbooks and Sage 50 for payroll and fast-track your career as an Accountant. These are some top-notched software used in organisations for bookkeeping, analysing cash flow, maintaining financial records and organising the data. So, excelling in these software will help you complete your task efficiently.

Why is it so essential to have expertise in Xero, Quickbooks and Sage 50 payroll? Firstly, most corporations use them to operate their financial task. Secondly, your skills in these topics will make you an exceptional candidate from others.

Therefore, join our Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping course to gain pertinent experience and knowledge about this software.

While going through this Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping, you will find some topics such as - QuickBooks bookkeeping, payroll management, maintaining financial records, Microsoft Office Essentials and functional IT. These subjects are included in the course to improve your skills.

So, if you are keen to gain knowledge about the mentioned topics, then sign up for our Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping course right now.

This Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping Bundle Consists of the following Premium courses:

Courses are included in this Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping Bundle?

- Course 01: Level 3 Xero Training

- Course 02: Diploma in Quickbooks Bookkeeping

- Course 03: Diploma in Sage 50 Accounts

- Course 04: Accounting & Bookkeeping Level 2

- Course 05: Payroll Management - Diploma

- Course 06: Essentials of UK VAT

- Course 07: Level 3 Tax Accounting

- Course 08: Pension UK

- Course 09: Employment Law Level 3

- Course 10: GDPR Data Protection Level 5

- Course 11: Level 2 Microsoft Office Essentials

Learning Outcomes of Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping:

After completing this Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping, learners will be able to:

- Get an introduction to QuickBooks bookkeeping

- Master data entry, transactions, track debits and maintain and monitor financial records

- Learn how to do payroll management, including wages and salary payments for all employees

- Enhance your accounting skill and understand UK pension, employment law, GDP etc

- Get an idea of how to present financial information

- Increase your knowledge of Microsoft Office Essentials

- Improve your functional IT skills to complete your tasks faster and more efficiently

So, without further ado, join our Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping course and complete it at your own pace.

CPD

Course media

Description

Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping

Whether you are a beginner or an expert thisXero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping is highly recommended to you. Since you have discussed each topic in detail, a beginner also feels comfortable doing this course. So, enrol n our Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping course to acquire more knowledge about Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping.

Course Curriculum Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping:

Course 01: Level 3 Xero Training

- Introduction

- Getting Started

- Invoices and Sales

- Bills and Purchases

- Bank Accounts

- Products and Services

- Fixed Assets

- Payroll

- VAT Returns

----------- 10 more courses--------

Certification of Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping:

- PDF Certificate: Free for all 11 courses

- Hard Copy Certificate: Free (For The Title Course: Previously it was £10)

Enrol in this Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping bundle course today and take your career to the next level!

Who is this course for?

This Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping bundle course is perfect for anyone who wants to learn about accounting and finance, or who wants to improve their skills in these areas. So, enrol the this extensive Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping training and boost your career.

Requirements

Anyone from any background can join this Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping course.

Career path

Finish this Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping course and gain the relevant knowledge that will help you to look for the following vocations:

- Financial analyst

- Accounting manager

- Associate Financial Advisor

So, Join our Xero, Quickbooks and Sage 50 for Payroll, Tax, Vat, Accounting & Bookkeeping course and complete it at your own pace.

Questions and answers

What level does this provide Level 1 ,2 or 3

Answer:Hi Lawrence, Good Afternoon. It's a bundle of 14 courses that consists of level-2 to level-4 courses.

This was helpful.Hi there, can u print out pdf certificate urself or at least email it to potential employer without the extra charge of 10 pounds each certificate?

Answer:Dear Samantha, Thank you for reaching out to us. The PDF certificate is for all 11 courses; they will be issued within 24 hours of you submitting a claim after completing the courses. Thanks

This was helpful.is this suitable for people who dont have any accounting experience but looking to get into it. does it include level 1 2 and 3 ?

Answer:Hi Richard, Good Afternoon. Yes, this is suitable for individuals who don't have any accounting experience but are looking to get into it.

This was helpful.

Certificates

Certificate of completion

Digital certificate - Included

Certificate of completion

Hard copy certificate - Included

You will get the Hard Copy certificate for the title course (Level 3 Xero Training) absolutely Free! Other Hard Copy certificates are available for £10 each.

Please Note: The delivery charge inside the UK is £3.99, and the international students must pay a £9.99 shipping cost.

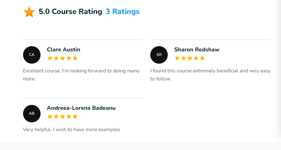

Reviews

Legal information

This course is advertised on reed.co.uk by the Course Provider, whose terms and conditions apply. Purchases are made directly from the Course Provider, and as such, content and materials are supplied by the Course Provider directly. Reed is acting as agent and not reseller in relation to this course. Reed's only responsibility is to facilitate your payment for the course. It is your responsibility to review and agree to the Course Provider's terms and conditions and satisfy yourself as to the suitability of the course you intend to purchase. Reed will not have any responsibility for the content of the course and/or associated materials.